Have you ever wondered why your auto insurance coverage is higher than your friend’s, even if you both drive similar vehicles and have nearly equal driving records? We’ll talk about your location, age, the way your credit score is calculated, and the kind of car you drive. All of these factors may affect how much your insurance costs. Let’s discuss the reasons why you can be paying more for almost the same coverage than your friend.

Driving Record

A major factor in deciding your vehicle insurance price is your driving record. Insurance firms pay great attention to this crucial element.

A good driving record free of any accidents or speeding tickets is extremely helpful. It is regarded as evidence of your careful driving practices and dependability behind the wheel.

Due to your decreased risk of being insured, your insurance rates will often be cheaper as a result.

On the other hand, if you are a bad driver and your record is ruined by accidents or traffic offenses, it may result in higher premiums.

Such a history would suggest to insurers that you’re more likely to file a claim, which would raise the price of your insurance. And for the bad drivers out there, it is difficult to find auto insurance with a bad driving record.

One hack to solve this problem is that if your driving skills are not that good, you should avoid making claims for minor damages. Instead, you can buy cheap car auto parts from AstroAI and get up to 48% off and repair your car on your own. By doing this, you can maintain a proper claim history.

Age and gender

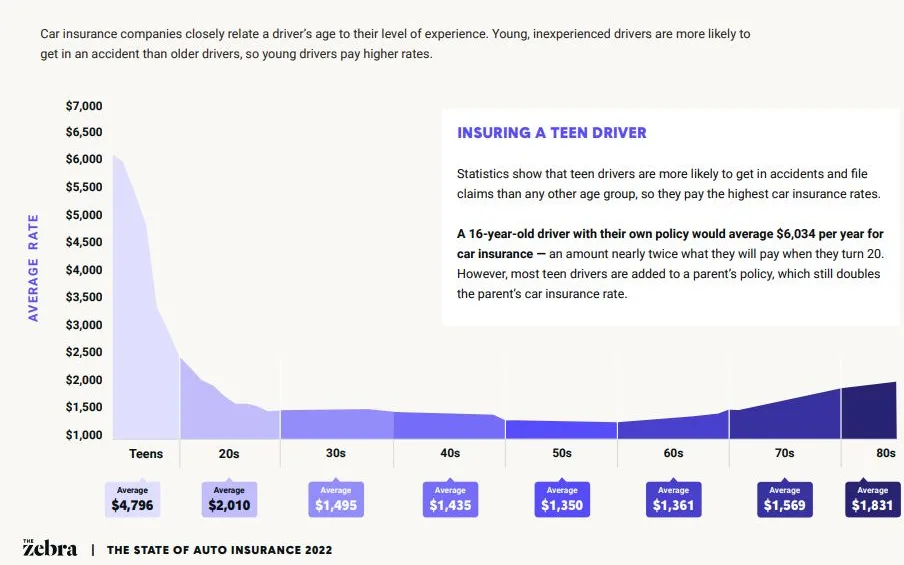

Age and gender are two major characteristics that impact vehicle insurance prices. Teenage drivers are often subject to higher premiums than older drivers.

In the above image, you can see car insurance rates by age. This is due to the fact that the data collected over the past decade indicates that they have a higher likelihood of being involved in accidents.

As a result, insurance companies view individuals as a higher risk and charge them extra for coverage.

Another factor in this equation is gender. Young male drivers sometimes pay more than their female counterparts for insurance. This is supported once more by statistics showing that young men are more inclined to drive recklessly, which increases the likelihood of accidents.

Nationally, the difference between what women and men pay for car insurance is insignificant (less than 0.1%). Interestingly, in 20 states, women pay more than men, and in 25 states, men pay more than women. (in 2022)

Location

Your vehicle insurance prices might vary greatly depending on where you live. Higher insurance costs are usual for the residents of urban regions, which are characterized by heavy traffic volumes and high crime rates.

The reason for this is simple: since accidents and car theft are more likely to happen in particular regions, insurance claims are also more likely to occur there.

In order to balance risk, insurance companies charge residents of these places greater rates, which reflects the increased claim chances.

Every claim incurred costs the insurance provider money, which is then divided among policyholders through premium payments.

On the other side, towns and cities typically have lower levels of traffic and crime. These elements help to reduce the possibility of accidents or theft, which lowers the possibility of insurance claims. As a result, rural residents frequently pay less for auto insurance.

In essence, the characteristics of your property, as well as the risks that come with it, have a significant impact on how much your auto insurance will cost. It’s yet another illustration of the practice of rating and pricing risk in insurance.

If you want to calculate the mortgage for your new house or anything else, you can use the Mortgage Calculator

For example, take the case of John and Jane, two people. John resides in an urban area with a high level of traffic and crime. His vehicle insurance costs are, thus, rather expensive. Jane, on the other hand, lives in a peaceful rural neighborhood with a low crime rate. She pays much less for insurance as a result than John does.

Type of vehicle

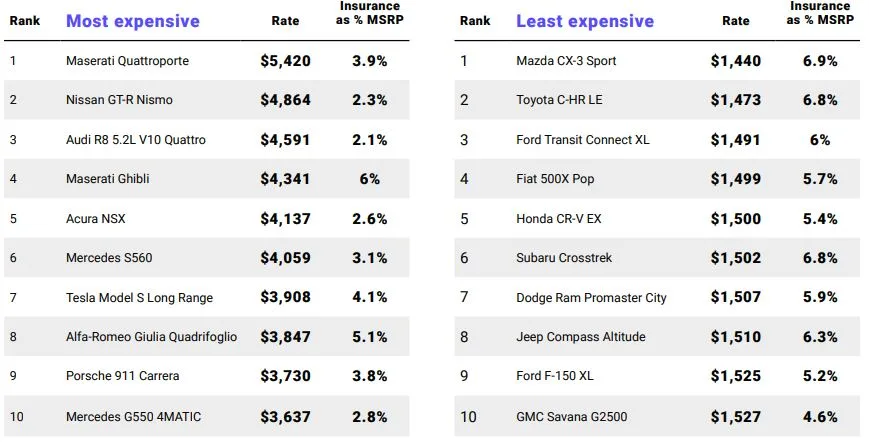

Your insurance costs are greatly impacted by the kind of car you drive. For example, you may be paying higher premiums if you drive a high-performance or fancy vehicle. The expense of maintaining or replacing such cars is the cause of this.

Imagine a situation where you drive a fast car. These fast automobiles frequently have strong engines and other high-end parts because they are designed for speed.

These parts can be expensive to repair or replace in the event of an accident. This is taken into consideration by insurance providers when calculating your premium.

Similar to this, high-end components and accessories are frequently seen in luxury vehicles. The expense of fixing or replacing these can be high.

Additionally, luxurious vehicles may attract criminals more easily, raising the risk associated with insurance.

The age of your vehicle affects the amount you pay for insurance as well. Because older automobiles may require more frequent maintenance, their premiums may be higher.

On the contrary, because they are more expensive to replace, more recent models may also have higher premiums.

In conclusion, the age and make of your vehicle are important considerations for insurance companies when determining your price.

Annual mileage

Your annual mileage may result in higher premiums for your auto insurance. This is because driving increases your risk of having an accident.

This may indicate that you travel frequently if you drive frequently for work or enjoy taking road vacations. Your likelihood of being involved in an accident rises as a result.

As a result, you may pay more for insurance since insurers view you as a larger risk. They take this action because they believe that the likelihood of having to pay for an accident is higher.

So keep in mind that driving less may result in lower auto insurance premiums.

Credit score

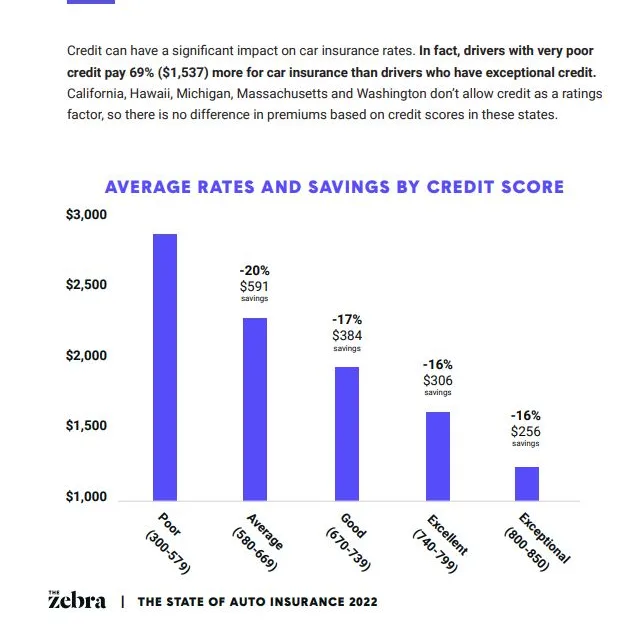

The amount you pay for auto insurance might be significantly influenced by your credit score.

When determining your insurance premiums, different countries require insurance providers to consider your credit score.

This is how it works: insurance companies view you as less risky if your credit score is high. They will charge you less for insurance because you are less likely to file a claim and miss payments, and vice versa if you have a lower credit score.

Keep in mind that not all states are like this. Certain states prohibit insurance companies from determining prices based on credit ratings.

However, In the USA, the practice of using credit scores to determine car insurance rates is banned in California, Hawaii, Massachusetts, and Michigan

In the UK, it’s not considered common practice for insurers to factor in your credit history to determine whether you will make a claim or default any payments

In Canada, it’s against the law for auto insurance companies to use your credit score in Ontario, Newfoundland and Labrador while deciding your insurance premium

Coverage History

The term “coverage history” describes how long you have held a life insurance policy and if you have kept it up-to-date without any cancellations or lapses.

Maintaining continuous insurance coverage with no lapses (even for a day!) is important because insurance companies view drivers who are already insured as financially responsible and therefore lower risk.

A history of continuous life insurance will show your responsibility and commitment to protect your loved ones.

California is the only state where insurance companies don’t take insurance history into consideration when setting rates

When you switch or renew your policy, it can also help you avoid paying more for medical tests or higher premiums.

Coverage and deductibles

Your choice of deductibles and coverage will affect the cost of your insurance. You will be better protected in the event of an emergency if you choose greater coverage and smaller deductibles, but your monthly insurance premium will go up.

So what are insurance coverage and deductibles?

Coverage: This is the amount that your insurance covers. More coverage results in greater protection for more items, but at a higher cost.

Deductibles: These are the out-of-pocket expenses you must pay before receiving insurance coverage. You will pay less up front but will have a higher monthly insurance payment if you choose a lower deductible.

In other words, it’s a trade-off between how much you want insurance to support you in times of need and what you can currently pay (lower rates).

Marital Status

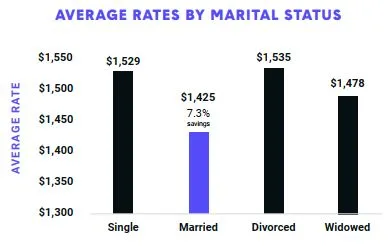

Statistics are used by insurance companies to evaluate an applicant’s risk of being insured. According to their results, married people are frequently less likely to be involved in accidents.

When single people get married, their car insurance rates drop about 7.3%, saving roughly $104/year. And when they get divorced, their rates shoot back up to those of a single person

Some states—including Montana, Michigan, and Hawaii—don’t allow the use of marital status in determining rates at all.

This may be the case due to the fact that married individuals typically lead more stable and responsible behaviors.

Therefore, choosing to get married may have more benefits than just finding a life partner—it may also result in lower insurance costs. For a lot of married couples, it’s like having two advantages.

It’s a win-win situation since you get to live with someone you love, and you could additionally save money on insurance.

Claim History

Your insurance premiums are directly impacted by the claims history you have with your insurer.

Insurance companies may consider you to be a higher risk if you have a history of filing multiple claims, such as for damage or accidents.

They may decide to raise your insurance premium as a result of this. In simple terms, you may have to pay more for coverage in the future the more claims you file.

Therefore, in order to maintain lower and cheaper insurance premiums, it’s a good idea to exercise caution and only file claims when absolutely necessary.

Driving Habits

The cost of insurance premiums can be significantly influenced by one’s driving behavior.

Your driving history is examined by insurance providers to determine your level of risk of an incident or accident.

Driving at night, making a long or excessive commute to work, having a history of accidents or traffic tickets, being an inexperienced driver, having serious convictions, and using a vehicle for business are examples of bad driving habits that have been shown to increase accidents and incidents.

As a result, auto insurance companies have good reason to raise premiums.

You can use telematics devices to lower insurance prices. Telematics devices can track your driving patterns and offer data that demonstrates your safety as a driver.

By facilitating quicker and more transparent access to driving data, telematics devices can also assist insurers in expeditiously and effectively resolving claims. The information sheds light on the reason behind mishaps, the extent of the harm, and the reaction time.

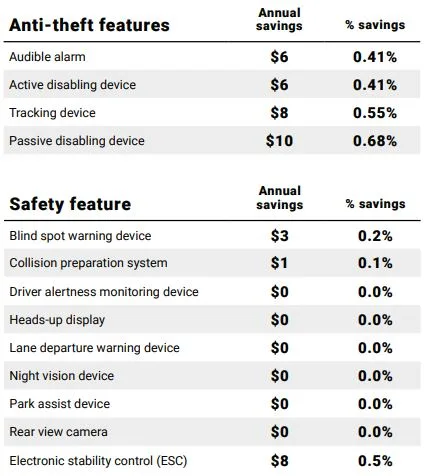

Anti-Theft and Safety Features

Insurance companies can evaluate the risk level of your vehicle and use anti-theft and safety features like wheel locks, kill switches, active disabling devices, and GPS tracking to calculate your premium.

Devices or systems known as safety features may reduce the probability or severity of incidents or losses involving your vehicle.

By reducing the likelihood and expense of claims, these features may enable you to receive discounts or reduced insurance policy premiums.

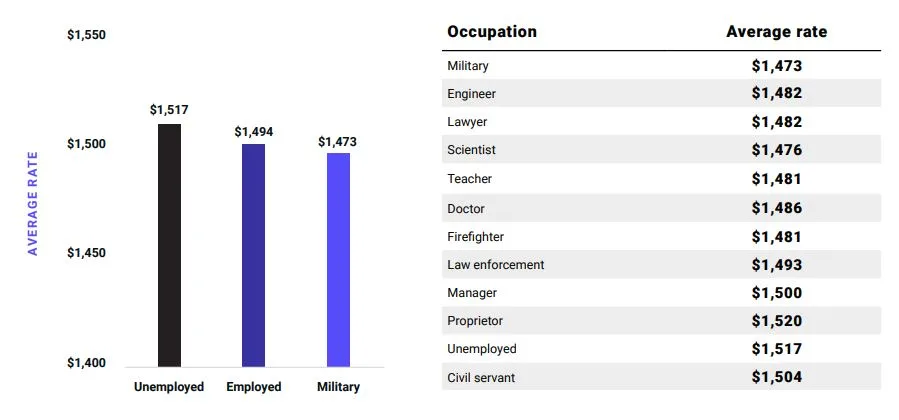

Occupation

The prices that insurance companies charge vary depending on the type of profession and the degree of risk involved. Certain jobs are insured at a higher rate than others because they are considered to be risky.

For instance, life insurance premiums may be higher for those employed in the mining, fishing, oil and gas, or airline industries than for those in office jobs.

This is due to their increased risk of passing away or suffering an injury at work.

Conversely, some professions may have reduced rates due to their reduced risk or potential rewards. For instance, premiums may be cheaper for those employed in the healthcare, education, or public service sectors than for those in the sales, marketing, or entertainment sectors.

This is because their health might be better, longer lifespans, or they might have access to employer-sponsored insurance

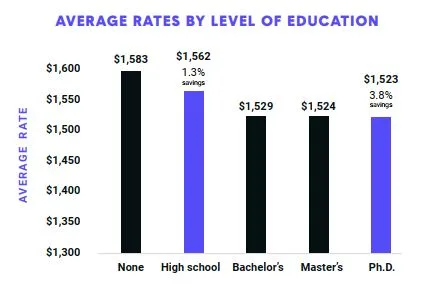

Education

Depending on the type of insurance, your degree of education may have an impact on your price.

If you have more knowledge, certain insurance companies might lower your life insurance or auto insurance premiums because they believe you’ll live longer, be in better health, or drive more safely.

However, not every insurer takes education into account, and certain jurisdictions might not permit it.

Education might not be as important for other insurance categories, including health or house insurance.

Alternatively, other variables like your property, health history, or income could be taken into account by insurers.

In the USA, several states like California, Georgia, Hawaii, Massachusetts, Montana, New York, and Carolina have prohibited insurance companies from taking education as a factor while calculating the insurance coverage of an individual

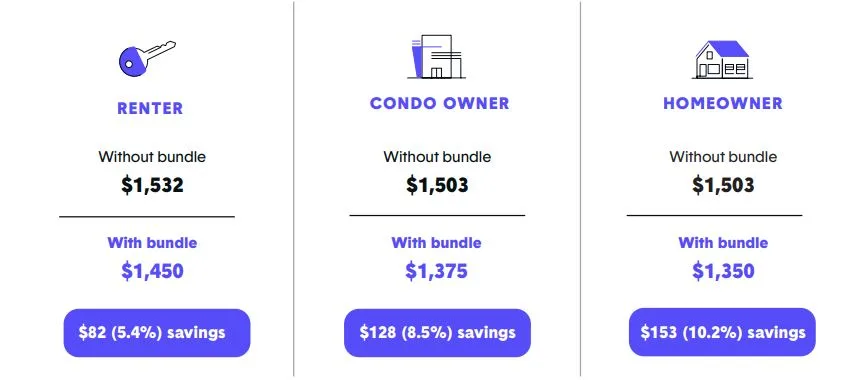

Bundling Policies:

Purchasing multiple insurance products from the same provider is known as bundling insurance policies. For instance, the same company may provide life, auto, and home insurance. In addition to saving you money and time, this can improve your coverage.

You can pay different prices for the same coverage if your friend and you have different kinds of insurance policies.

For instance, you can pay less than your friend, who has individual policies from different carriers, if you have a bundle policy from the same provider that covers your life, auto, and house insurance.

This is due to the fact that combining insurance policies can result in savings, lower your chance of having inadequate or excessive coverage, and make it easier to file and settlement of claims.

Conclusion

In conclusion, if you’ve made it this far, you’ve likely learned why your insurance premium prices might differ from those of your friends.

It’s a conversation worth having with your friends to ensure you’re all making informed decisions about your insurance coverage. By now, you’ve gained valuable insights into how to secure the best deals on your insurance, all while keeping your needs and budget in mind.

Remember, it’s not just about saving money but also about having the right coverage to safeguard yourself and your assets in the face of unexpected events. So, consider these factors, explore your options, and make well-informed choices to optimize your insurance coverage.

It’s a step toward both financial security and peace of mind. I have listed a few insurance plans that might help you get a suitable policy according to your needs and budget, so don’t forget to check those out. Please note that the above data is taken from The Zebra an insurance comparison site.

If this article was helpful to you in knowing why your insurance coverage is different from that of your friend, then please let me know in the comment section.

1 thought on “Why Are You Paying More for Car Insurance Than Your Friend?”

Pingback: Beware of 10 Shocking Reasons Why Insurance Claims Rejected | AllYouNeedToKnow